2024 Quarter 2 Market Update

2024 Quarter 2 - Market Update

2nd Quarter Returns:

Large Cap U.S. (VOO): 4.41%

Small Cap U.S. (VSCIX): -4.15%

International (VXUS): 0.81%

U.S. Bond Agg (Agg): 0.03%

2nd Quarter Market Update:

As we reflect on the second quarter of 2024, the global markets have shown resilience in the face of continued geopolitical tensions and economic uncertainties. Here are the highlights and trends from the quarter:

Equity markets experienced mixed performance during the 2nd quarter. Large, U.S. growth companies outperformed, with the S&P 500 and NASDAQ indices hitting new highs.

Sector-wise, technology stocks have led the charge, benefiting from increased adoption of cloud computing, artificial intelligence, and cybersecurity solutions. While the technology sector has outperformed, we do recognize stretched valuations, and we remain cautious of being overexposed.

Fixed income securities were flat as interest rates ticked higher. While today's environment is more attractive for bond holders, corporate and municipal spreads remain tight. We're finding the best value in the private lending sector.

Money markets, CDs, and Treasuries are still paying attractive interest as the Fed has delayed decreasing the terminal rates. We still encourage anyone with large bank cash positions to take advantage of this opportunity.

This quarter, I wanted to highlight our services and technology around client experience and visibility. See below for examples of each resource (these are all mock clients and data):

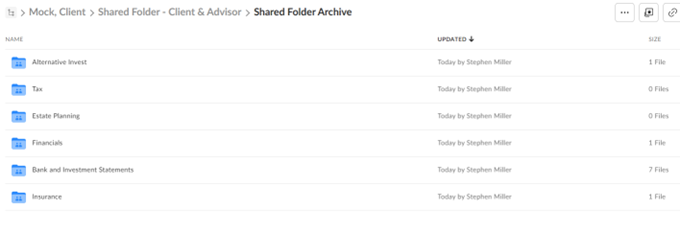

BOX: This is our secure digital file storage center. We save all important documents to each client's personal Box folder. You have access to these files, and you can upload and share any files from your computer onto the same Box folder. It's a great storage center for your financial organization, and it's beneficial for your spouse and beneficiaries.

Black Diamond Wealth Platform: This is our portfolio reporting center. You can view your own portfolio data like performance, activity and cash flow, projected income, allocation, and more.

eMoney: This is our planning and forecasting tool. While we often use this analysis in client reviews, you can relook at your plan's outlook at any time. You can also link to outside-held accounts if we don't already have this information.

Parker is very seasoned and knowledgeable in onboarding clients to these websites, and he offers training meetings for anyone who'd like to fully utilize these resources. I encourage everyone with interest to email me or Parker, and we'll set up a Client Experience and Visibility meeting.

Sincerely,

Stephen W. Miller, CIMA, CRPC® James E. Miller, CFP®

Senior Financial Advisor Senior Financial Advisor

J. Parker Morris, CFP®

Financial Advisor